neopin.io - Permissioned DeFi Protocol

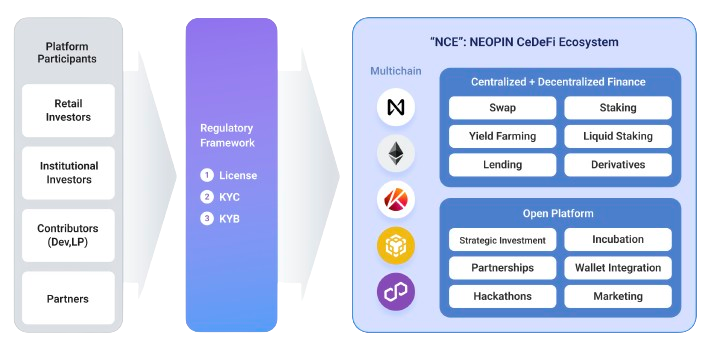

NEOPIN is a Permissioned DeFi protocol with an innovative market approach, taking advantage of CeFi and DeFi.

What is Permissioned DeFi?

- Permissioned DeFi is a new concept that aims to bridge the gap between centralized finance (CeFi) and decentralized finance (DeFi). The idea behind Permissioned DeFi is to take the best aspects of both CeFi and DeFi and combine them to create a financial ecosystem that is more efficient, transparent, and user-friendly.

- CeFi has a reputation for stability, security and regulatory compliance, but it lacks transparency and accessibility. On the other hand, DeFi has a reputation for transparency, accessibility and innovation, but it can be lacking in terms of stability, security and regulatory compliance. Permissioned DeFi aims to solve these problems by leveraging the strengths of both CeFi and DeFi, such as providing a stable and secure platform with regulatory compliance, while also providing transparency and accessibility as well as innovation and flexibility.

- The Permissioned DeFi ecosystem is expected to benefit the financial industry, although it is still relatively new and rapidly evolving. For this reason, NEOPIN offers DeFi products such as yield farming, lending, borrowing, liquidity staking and token swapping, which are available on the DeFi protocols and at the same time are compliant in terms of regulation and traditional finance institution-level security.

How does NEOPIN act as a Permissioned DeFi platform?

- The centralized aspect of NEOPIN is that we verify the identification of all participants, both users and businesses. It means that we filter out any malicious actors and stay regulatory compliant.

- The decentralized aspect of NEOPIN allows users to have full control over their assets with a non-custodial wallet environment, and utilize completely decentralized products running on the major blockchain networks.

- By bringing the two together, we hope to protect users from harm while providing innovative financial alternatives to traditional finance.